I'm finding it rather hard to reconcile the dichotomy of free market banking system (and the greedy beast it has mutated into) and the requirement of a strong, regulated financial institution for development (and the bailouts they entail). Allow me to elucidate.

It is imperative for an economy to have a strong banking system to allow the flow of capital between people who wish to seek a return on their earnings and people who require it to pursue business ideas. The banking system is supposed to take the money from folks who do not require it at the moment and feed it into ideas. Traditionally the banking system invested in ideas with real world implications - i.e. businesses that were actually adding value to the economy. Manufacturing cars, designing a new dress, or even researching the benefits of monkey poo. All of this created real growth in the system, the bank made money and the people who invested in the banks received interest and viola, we had progress. Simple enough?

Of course, there are caveats to this strategy. How do we determine what is a good idea? Can we know for sure that an investment will create positive returns in the long run? The element of risk has always cast a shadow on the will to commit other people's money to a business idea.

Government banking institutions, which are required to be solid, risk-less, and "blue chip", are averse to investing in ideas that are "edgy" or "untested" leaving a lot of interesting ideas unfunded and unrealized. This gap is bridged by venture capitalists [1]. Good VCs very quickly realized that in a growing ADD market, 9 out of 10 ideas were prone to fail, but it was that 1 golden goose that was enough to cover all past misgivings. Consider Sequoia and Google. That is not to say that VCs will go to bed with anybody, but they truly embrace the golden maxim of investments - "no risk, no return".

This system works great in an economy with low levels of information asymmetry, minimal bureaucracy, and the belief that good ideas are going to be funded. Without this belief, perhaps a lot of great ideas die in our minds because we do not think that pursuing them will lead anywhere. With this holy trinity, we can create a system where ordinary citizens can "dream". We can give life to ideas, and move the economy in a forward direction, and create a new benchmark in development. This, in modern parlance, we call "innovation".

Now consider a country like India or any other developing nation for instance. We have such a primitive banking system, that we require to have collateral for student loans! A risk averse banking system in an economy where there is no other alternative to raise funding, is a serious detriment to development. Indian banks primarily target asset loans which assure the bank of a fixed return on the investment and SMEs and ideas are ignored as being too "risky". Hence, even though people harp about India's massive human capital growth in the last decade, we, as a nation, have contributed minimally to global innovation. A statement reiterated by Israeli Consulate General in Bangalore, Menahem Kanafi.

Much as we've come to belittle corporations and the world of finance as evil, they are definitely a necessary evil when we consider their impact on the real economy [2]. So the question we now need to ask is, do we leave the banking sector to its own devices and hope that the public awareness increases, or should governments regulate the market. An age old question free market economists and Keynesians have been arguing for the last century. Consider a return to these two videos I had posted in 2011. I shall leave the argument about the inefficiency of central banking for another day.

Keynes vs. Hayek Round 1

Keynes vs. Hayek Round 2

However, modern financial systems have become an unmanageable beast. Most of us are already aware of the massive implications of corporate greed in the 1998 Financial Crisis so let us take a more subtle example. Let us use education.

It is imperative for an economy to have a strong banking system to allow the flow of capital between people who wish to seek a return on their earnings and people who require it to pursue business ideas. The banking system is supposed to take the money from folks who do not require it at the moment and feed it into ideas. Traditionally the banking system invested in ideas with real world implications - i.e. businesses that were actually adding value to the economy. Manufacturing cars, designing a new dress, or even researching the benefits of monkey poo. All of this created real growth in the system, the bank made money and the people who invested in the banks received interest and viola, we had progress. Simple enough?

Of course, there are caveats to this strategy. How do we determine what is a good idea? Can we know for sure that an investment will create positive returns in the long run? The element of risk has always cast a shadow on the will to commit other people's money to a business idea.

Government banking institutions, which are required to be solid, risk-less, and "blue chip", are averse to investing in ideas that are "edgy" or "untested" leaving a lot of interesting ideas unfunded and unrealized. This gap is bridged by venture capitalists [1]. Good VCs very quickly realized that in a growing ADD market, 9 out of 10 ideas were prone to fail, but it was that 1 golden goose that was enough to cover all past misgivings. Consider Sequoia and Google. That is not to say that VCs will go to bed with anybody, but they truly embrace the golden maxim of investments - "no risk, no return".

This system works great in an economy with low levels of information asymmetry, minimal bureaucracy, and the belief that good ideas are going to be funded. Without this belief, perhaps a lot of great ideas die in our minds because we do not think that pursuing them will lead anywhere. With this holy trinity, we can create a system where ordinary citizens can "dream". We can give life to ideas, and move the economy in a forward direction, and create a new benchmark in development. This, in modern parlance, we call "innovation".

Now consider a country like India or any other developing nation for instance. We have such a primitive banking system, that we require to have collateral for student loans! A risk averse banking system in an economy where there is no other alternative to raise funding, is a serious detriment to development. Indian banks primarily target asset loans which assure the bank of a fixed return on the investment and SMEs and ideas are ignored as being too "risky". Hence, even though people harp about India's massive human capital growth in the last decade, we, as a nation, have contributed minimally to global innovation. A statement reiterated by Israeli Consulate General in Bangalore, Menahem Kanafi.

Much as we've come to belittle corporations and the world of finance as evil, they are definitely a necessary evil when we consider their impact on the real economy [2]. So the question we now need to ask is, do we leave the banking sector to its own devices and hope that the public awareness increases, or should governments regulate the market. An age old question free market economists and Keynesians have been arguing for the last century. Consider a return to these two videos I had posted in 2011. I shall leave the argument about the inefficiency of central banking for another day.

Keynes vs. Hayek Round 1

Keynes vs. Hayek Round 2

However, modern financial systems have become an unmanageable beast. Most of us are already aware of the massive implications of corporate greed in the 1998 Financial Crisis so let us take a more subtle example. Let us use education.

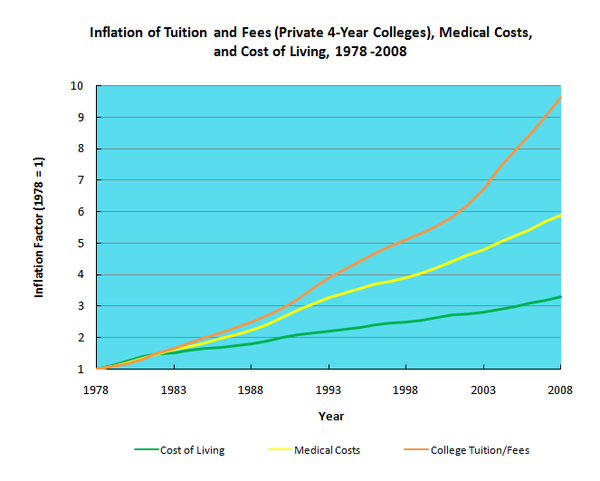

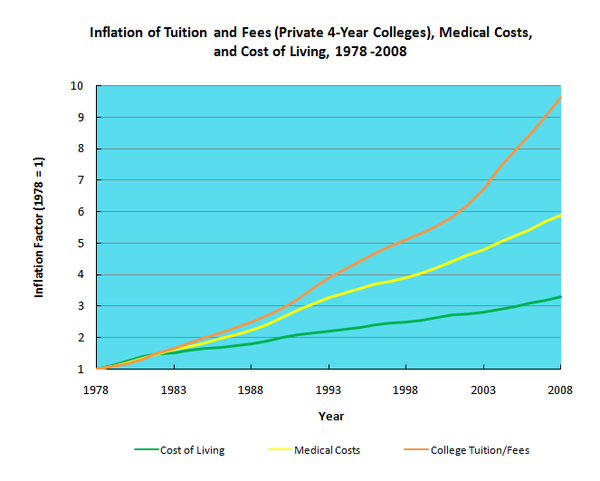

The above graph (CollegeBoard) shows that increase in college tuition fee has far exceeded inflation rates in the US. Considering most colleges, at least, the state universities are non-profit institutions, what could be the reason behind this sharp increase in tuition fees?

There are several theories floating in the academic circles, including, a potential "higher education bubble", or a decrease in government appropriation into the education system, mismanagement of endowments, and lack of consumer protection. Personally, I posit that the federal students loans program has played a large role in not only raising college tuition, but also herding our top engineering and science students into the corporate and banking sector.

Since the federal government started providing low interest student loans to make education more affordable, this increased the market for higher education, allowing universities and colleges to hike up their tuition fees by recognizing that now more students had access to money to afford these higher fees. Unfortunately, this system led to students graduating college with massive amounts of debt, and instead of pursuing vocations they were really interested in, were forced into majoring in subjects that would provide the maximum employment opportunity upon graduation. This phenomenon caused a large increase in students pursuing subjects like economics and finance, and of course, the ubiquitous MBA.

Why does an MBA cost so much when one can learn pretty much all the material through Khan Academy and a library card (read Good Will Hunting) in six months. Well, first, it provides you with a stamp of legitimacy - we live in a paradigm of label-able education. Although in my opinion, knowledge and literacy almost has nothing to do with being educated. I have found many "MBAs" pretentious and arrogant [3]. Even worse is the increasing trend of engineers pursuing MBAs to take up corporate management positions, ridding the world of clever engineers and replacing them with greed infused suits. Second, this "need" to do an MBA has made the demand for the degree sky rocket allowing schools to charge fees which in any other profession would be called highway robbery...

So, the banking system, through their loans, allows colleges to increase their tuition, encumbering students with massive loans so they end up taking jobs with the said banks after they graduate... an unusually unhealthy system. Can we break down this system? Should the US federal government stop giving out low interest loans? Should education be completely free market? Doesn't that skew the level playing field then? Should governments cap tuition fees like in the UK, or make colleges free like in Europe? Whoa, that sounds like socialism... I don't have the answers, but it's something to think about.

Addendum: 24 September 2014

Here is John Oliver's ("Last Week Tonight with John Oliver") brilliant and hilarious take on the Student Debt Crisis, from an angle I had never considered before. Consider meself suitably humbled.

[1] Understand that Investment Banks do not actually invest in ideas... they invest in existing businesses for vast commissions. While IBs may also be adding to the real economy, they do not necessarily push for innovation. An IBs primary goals are M&A, financing solutions, corporate consulting and risk management, and investment solutions. This is vastly different from VCs. Similarly, merchant, corporate and commercial banks do also invest into new businesses but deal with vast capital and not particularly with new ideas.

[2] Let us, for the sake of argument, ignore the manner in which banks create fictitious wealth through complex financial instruments that serve no purpose but to sponsor bonus checks.

[3] I remember a person once tried to get me to buy into an Amway type pyramid scheme, and when I painstakingly pointed out all the inherent fallacies in his arguments, he asked me with a sneer, "Do you have an MBA?" "No", I had replied. "Well I do, and I'm telling you this works." Case closed.

There are several theories floating in the academic circles, including, a potential "higher education bubble", or a decrease in government appropriation into the education system, mismanagement of endowments, and lack of consumer protection. Personally, I posit that the federal students loans program has played a large role in not only raising college tuition, but also herding our top engineering and science students into the corporate and banking sector.

Since the federal government started providing low interest student loans to make education more affordable, this increased the market for higher education, allowing universities and colleges to hike up their tuition fees by recognizing that now more students had access to money to afford these higher fees. Unfortunately, this system led to students graduating college with massive amounts of debt, and instead of pursuing vocations they were really interested in, were forced into majoring in subjects that would provide the maximum employment opportunity upon graduation. This phenomenon caused a large increase in students pursuing subjects like economics and finance, and of course, the ubiquitous MBA.

Why does an MBA cost so much when one can learn pretty much all the material through Khan Academy and a library card (read Good Will Hunting) in six months. Well, first, it provides you with a stamp of legitimacy - we live in a paradigm of label-able education. Although in my opinion, knowledge and literacy almost has nothing to do with being educated. I have found many "MBAs" pretentious and arrogant [3]. Even worse is the increasing trend of engineers pursuing MBAs to take up corporate management positions, ridding the world of clever engineers and replacing them with greed infused suits. Second, this "need" to do an MBA has made the demand for the degree sky rocket allowing schools to charge fees which in any other profession would be called highway robbery...

So, the banking system, through their loans, allows colleges to increase their tuition, encumbering students with massive loans so they end up taking jobs with the said banks after they graduate... an unusually unhealthy system. Can we break down this system? Should the US federal government stop giving out low interest loans? Should education be completely free market? Doesn't that skew the level playing field then? Should governments cap tuition fees like in the UK, or make colleges free like in Europe? Whoa, that sounds like socialism... I don't have the answers, but it's something to think about.

Addendum: 24 September 2014

Here is John Oliver's ("Last Week Tonight with John Oliver") brilliant and hilarious take on the Student Debt Crisis, from an angle I had never considered before. Consider meself suitably humbled.

[1] Understand that Investment Banks do not actually invest in ideas... they invest in existing businesses for vast commissions. While IBs may also be adding to the real economy, they do not necessarily push for innovation. An IBs primary goals are M&A, financing solutions, corporate consulting and risk management, and investment solutions. This is vastly different from VCs. Similarly, merchant, corporate and commercial banks do also invest into new businesses but deal with vast capital and not particularly with new ideas.

[2] Let us, for the sake of argument, ignore the manner in which banks create fictitious wealth through complex financial instruments that serve no purpose but to sponsor bonus checks.

[3] I remember a person once tried to get me to buy into an Amway type pyramid scheme, and when I painstakingly pointed out all the inherent fallacies in his arguments, he asked me with a sneer, "Do you have an MBA?" "No", I had replied. "Well I do, and I'm telling you this works." Case closed.